Aggrieved by the said action of the Commercial Tax Officer, the appellants filed Writ Petitions 1195 to 1198 of 1975 and 3931, 3944 and 4929 of 1975 in the High Court of Andhra Pradesh challenging the said notices which, as already stated, were dismissed by the High Court. 3. The appellant in Appeal 693 of 1976 is a firm which is a licensed.. Review income tax returns, monitor tax-deductible expenses, and issue business permits and licenses as and when required. Manage and improve internal tax audit capabilities to identify tax exposures and compliance risks before external audits take place. Maintain the company’s tax database, update tax rates, and correct data errors to ensure.

Commercial tax inspector recruitment 2022/23 KPSC RECRUITMENT IN KANNADA syllabus kpsc

Two Commercial Tax officers Arrested for Accepting Bribe of Rs 40,000 in Hyderabad

Junior Commercial Tax Officer Promotion Scale ACTO Promotion RAS, RPSC,Promotion YouTube

KPSC 2019 TOPPER PRIYANKA.N Tax Officer) YouTube

Tax Officer Exam 2023 2024 EduVark

Timewell Technics Pvt. Ltd. v. Commissioner of C. Ex., Rajkot Indian Law Portal

Commercial tax officer goes viral MBCtv YouTube

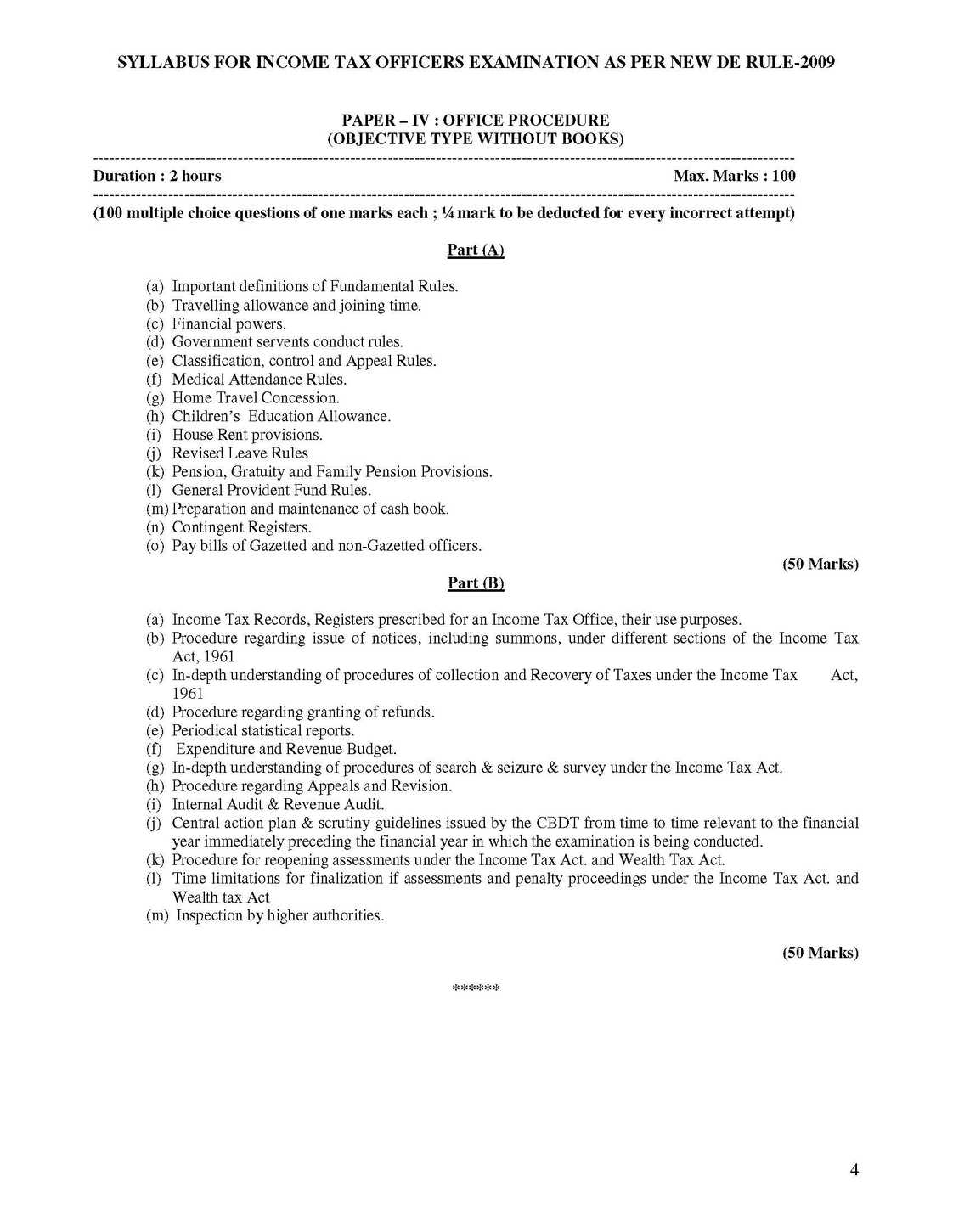

KPSC Commercial Tax Officer Syllabus & Exam Pattern 2020 Download

Deputy Commissioner Commercial Tax Officer in ACB Net Hyderabad Overseas News YouTube

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

BPSC Topper Aniket Amar, Commercial Tax Officer. (Rank 46) Mock Interview YouTube

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

COMMERCIAL TAX OFFICER FEBRUARY 2,2015 FULL SOLVED PAPER EXAMCHOICES.IN

Wastage of oil Taxscan Simplifying Tax Laws

Tax Department conducts searches in Tamil Nadu Here is a complete guide

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

OSSC ACTO Answer Key 2019 OUT Download Assistant Commercial Tax Officer

UPPSC Topper Ashish Mathur, Commercial Tax Officer Mock Interview YouTube

Part III OSSC ASSISTANT COMMERCIAL TAX OFFICER PREVIOUS YEAR QUESTION PAPER

Non-resident corporations. A non-resident corporation has to file a T2 return if, at any time in the year, one of the following situations applies:. it carried on business in Canada; it had a taxable capital gain; it disposed of taxable Canadian property, unless the disposition meets all the criteria listed below; This requirement applies even if the corporation claims that any profits or.. Withholding tax on passive income of non-residents. The ITA imposes withholding tax at a rate of 25 per cent on the gross amount of certain payments made by a resident of Canada to a non-resident, including management fees, dividends, rents and royalties. This rate may be reduced pursuant to an applicable tax treaty.