Navy Federal Credit Union’s home equity line of credit, or HELOC, stands out for its long draw period (at 20 years, it’s twice as long as most) and a high combined loan-to-value ratio of 95%.. Affordability: 10/10. Overall, Navy Federal Credit Union’s mortgage rates are competitive. It charges a 1 percent origination fee but offers the option to waive the fee in exchange for a higher.

How To Get a Navy Federal Credit Union Business Account. YouTube

HOW To GET APPROVED For Navy Federal MORTGAGE…🏡 [CREDIT SCORE

Navy Federal Credit Union Foreclosure Assistance Home Relief Program

How To Track Loan Status On Navy Federal

NAVY FEDERAL CREDIT UNION Credit Union Near Me

Navy Federal Credit Union Review Serving Those Who Have Served

Navy Federal Credit Union Home Facebook

Navy Federal Credit Union Premieres HomeSquad

Navy Federal Mortgage 2023 Review The Ascent

Navy Federal Mortgage Review for 2020 Best Mortgage Lenders, Refinance

A new, easy home equity loan experience with HomeSquad. Insured by NCUA

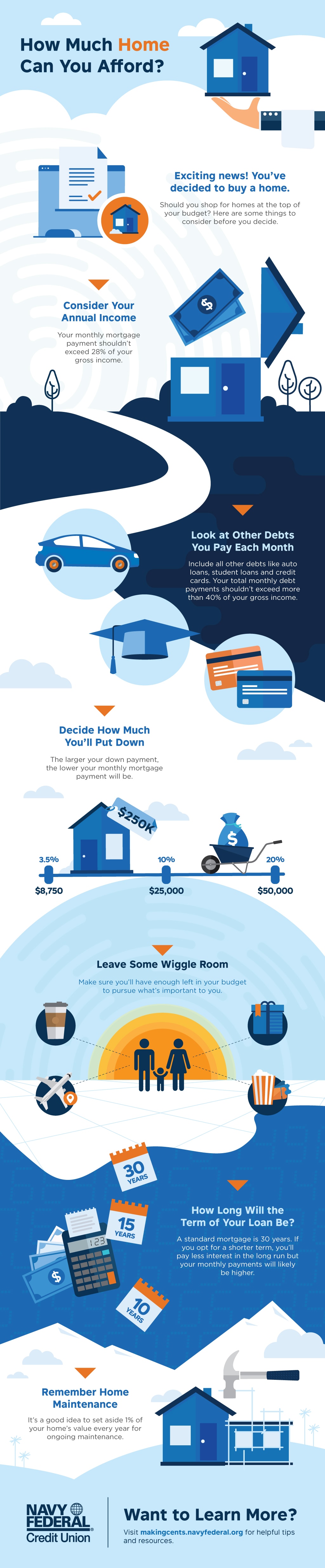

How Much Home Can You Afford? MakingCents Navy Federal Credit Union

Best Mortgage Lenders Near Navy Federal Credit Union in Saint Louis

Navy Federal Credit Union Mortgage is NO MONEY DOWN With NO PMI YouTube

Navy Federal Credit Union Lawton OK

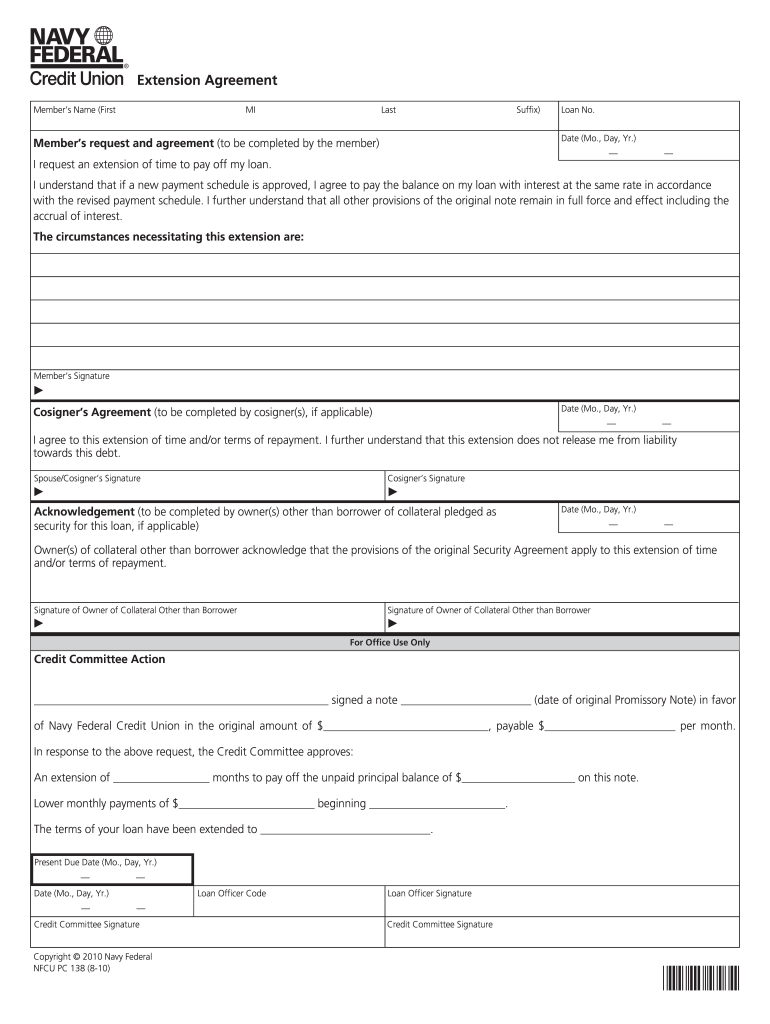

Navy Federal Loan Extension Fill Online, Printable, Fillable, Blank

Navy Federal Credit Union Mortgage Review 2021 US News

navy federal home equity loan credit score Hole Newsletter Art Gallery

Navy Federal Credit Union Review

Navy Federal Review VA Loans The Sacramento Bee

Jumbo Homebuyers Choice loans are loan amounts above $766,550 up to $1,000,000. A Jumbo Fixed loan of $800,000 for 30 years at 6.750% interest and 6.898% APR will have a monthly payment of $5,188. Taxes and insurance not included; therefore, the actual payment obligation will be greater.. Navy Federal is the largest credit union in the U.S., with $165 billion in assets and 354 branches worldwide. BBB Rating NR. year established 1933. customer service rating. 4.3 out of 5. Best.